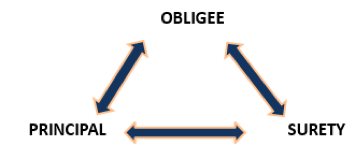

Principal: A Contractor who is performing a service on a project.

Obligee: Who the Principal’s contract is with (i.e. GC or another Contractor)

Surety: The Insurance Market/Carrier who provides the bond

If you are a Contractor (Principal) working on a project and have a contract with the General Contractor (Obligee), the GC may require that you have a surety bond for that project. The surety bond is for the amount of work that you are performing on that specific project. If your contract is for $10,000, the surety bond is for the same amount. The bond covers the Principal’s contract with the Obligee.

The Principal will reach out to their Surety Broker to obtain a bond. The Broker reviews the Principal’s company financials and submits that to different markets. They review the options with the Principal and pick the best Surety for them. The Surety will then issue a bond to the Obligee based on the Principal’s contract.

If the Principal is unable to meet their contract requirements with the Obligee, the Surety has a couple main options.

If the Principal does not have a Surety Bond, they are responsible if something happens and cannot meet their contract requirements. As a contractor, surety bonds can keep you competitive in the marketplace, regarding bonding capacity and bond rates. Be sure to understand the different types of surety bonds prior to deciding on a course of action.

image credit: Tom Tomczyk/shutterstock.com

Comments